OECD GloBE Rules

Globe Rules Article 1 Scope

Operation of the rules in this chapter

Chapter 1 defines the scope of the rules.

- Article 1.1 determines which MNE Groups and Group Entities are subject to the GloBE Rules.

- Article 1.2 to Article 1.4 set out a number of key definitions that are used to determine when an Entity or collection of Entities constitutes a Group and when that Group qualifies as an MNE Group.

- Article 1.5 specifies those Entities that are Excluded Entities and therefore outside the operative provisions of the GloBE Rules.

Globe Rules Article 1.1. Scope of GloBE Rules

1.1.1. The GloBE Rules apply to Constituent Entities that are members of an MNE Group that has annual revenue of EUR 750 million or more in the Consolidated Financial Statements of the Ultimate Parent Entity (UPE) in at least two of the four Fiscal Years immediately preceding the tested Fiscal Year. Further rules are set out in Article 6.1 which modify the application of the consolidated revenue threshold in certain cases.

1.1.2. If one or more of the Fiscal Years of the MNE Group taken into account for purposes of Article 1.1.1 is of a period other than 12 months, for each of those Fiscal Years the EUR 750 million threshold is adjusted proportionally to correspond with the length of the relevant Fiscal Year.

1.1.3. Entities that are Excluded Entities are not subject to the GloBE Rules.

Globe Rules Article 1.2. MNE Group and Group

1.2.1. An MNE Group means any Group that includes at least one Entity or Permanent Establishment that is not located in the jurisdiction of the Ultimate Parent Entity.

1.2.2. A Group means a collection of Entities that are related through ownership or control such that the assets, liabilities, income, expenses and cash flows of those Entities:

(a) are included in the Consolidated Financial Statements of the Ultimate Parent Entity; or

(b) are excluded from the Consolidated Financial Statements of the Ultimate Parent Entity solely on size or materiality grounds, or on the grounds that the Entity is held for sale.

1.2.3. A Group also means an Entity that is located in one jurisdiction and has one or more Permanent Establishments located in other jurisdictions provided that the Entity is not a part of another Group described in Article 1.2.2.

Globe Rules Article 1.3. Constituent Entity

1.3.1. A Constituent Entity is:

(a) any Entity that is included in a Group; and

(b) any Permanent Establishment of a Main Entity that is within paragraph (a).

1.3.2. A Permanent Establishment that is a Constituent Entity under paragraph (b) above shall be treated as separate from the Main Entity and any other Permanent Establishment of that Main Entity.

1.3.3. A Constituent Entity does not include an Entity that is an Excluded Entity.

Globe Rules Article 1.4. Ultimate Parent Entity

1.4.1. Ultimate Parent Entity means either:

(a) an Entity that:

i. owns directly or indirectly a Controlling Interest in any other Entity; and

ii. is not owned, with a Controlling Interest, directly or indirectly by another Entity; or

(b) the Main Entity of a Group that is within Article 1.2.3.

Globe Rules Article 1.5. Excluded Entity

1.5.1. An Excluded Entity is an Entity that is:

(a) a Governmental Entity;

(b) an International Organisation;

(c) a Non-profit Organisation;

(d) a Pension Fund;

(e) an Investment Fund that is an Ultimate Parent Entity; or

(f) a Real Estate Investment Vehicle that is an Ultimate Parent Entity.

1.5.2. An Excluded Entity is also an Entity:

(a) where at least 95% of the value of the Entity is owned (directly or through a chain of Excluded Entities) by one or more Excluded Entities referred to in Article 1.5.1 (other than a Pension Services Entity) and where that Entity:

i. operates exclusively or almost exclusively to hold assets or invest funds for the benefit of the Excluded Entity or Entities; or

ii. only carries out activities that are ancillary to those carried out by the Excluded Entity or Entities; or

(b) where at least 85% of the value of the Entity is owned (directly or through a chain of Excluded Entities), by one or more Excluded Entities referred to in Article 1.5.1 (other than a Pension Services Entity) provided that substantially all of the Entity’s income is Excluded Dividends or Excluded Equity Gain or Loss that is excluded from the computation of GloBE Income or Loss in accordance with Articles 3.2.1(b) or (c).

1.5.3. A Filing Constituent Entity may elect not to treat an Entity as an Excluded Entity under Article 1.5.2. An election under this Article is a Five-Year Election.

Globe Rules Article 2 Charging Provisions

Operation of the rules in this chapter

Under this chapter, the amount of Top-Up Tax charged to a Parent Entity or to the Constituent Entities located in a UTPR Jurisdiction is determined:

- by attributing the Top-Up Tax of each Low-Taxed Constituent Entity determined under the rules in Chapter 5 to the Parent Entity under the IIR in accordance with Article 2.1 to Article 2.3; and then

- by allocating the residual Top-Up Tax, if any, to UTPR Jurisdictions in accordance with Article 2.4 to Article 2.6.

Globe Rules Article 2.1. Application of the IIR

2.1.1. A Constituent Entity, that is the Ultimate Parent Entity of an MNE Group, located in [insert name of implementing-jurisdiction] that owns (directly or indirectly) an Ownership Interest in a Low Taxed Constituent Entity at any time during the Fiscal Year shall pay a tax in an amount equal to its Allocable Share of the Top-Up Tax of that Low-Taxed Constituent Entity for the Fiscal Year.

2.1.2. An Intermediate Parent Entity of an MNE Group located in [insert name of implementing jurisdiction] that owns (directly or indirectly) an Ownership Interest in a Low-Taxed Constituent Entity at any time during a Fiscal Year shall pay a tax in an amount equal to its Allocable Share of the Top Up Tax of that Low-Taxed Constituent Entity for the Fiscal Year.

2.1.3. Article 2.1.2 shall not apply if:

(a) the Ultimate Parent Entity of the MNE Group is required to apply a Qualified IIR for that Fiscal Year; or

(b) another Intermediate Parent Entity that owns (directly or indirectly) a Controlling Interest in the Intermediate Parent Entity is required to apply a Qualified IIR for that Fiscal Year.

2.1.4. Notwithstanding Articles 2.1.1 to 2.1.3, a Partially-Owned Parent Entity located in [insert name of implementing-jurisdiction] that owns (directly or indirectly) an Ownership Interest in a Low Taxed Constituent Entity at any time during the Fiscal Year shall pay a tax in an amount equal to its Allocable Share of the Top-up Tax of that Low-Taxed Constituent Entity for the Fiscal Year.

2.1.5. Article 2.1.4 shall not apply if the Partially-Owned Parent Entity is wholly owned (directly or indirectly) by another Partially-Owned Parent Entity that is required to apply a Qualified IIR for that Fiscal Year.

2.1.6. A Parent Entity located in [insert name of implementing-jurisdiction] shall apply the provisions of Articles 2.1.1 to 2.1.5 with respect to a Low-Taxed Constituent Entity that is not located in [insert name of implementing-jurisdiction].

Globe Rules Article 2.2. Allocation of Top-Up Tax under the IIR

2.2.1. A Parent Entity’s Allocable Share of the Top-up Tax of a Low-Taxed Constituent Entity is an amount equal to the Top-up Tax of the Low-Taxed Constituent Entity as calculated under Chapter 5 multiplied by the Parent Entity’s Inclusion Ratio for the Low-Taxed Constituent Entity for the Fiscal Year.

2.2.2. A Parent Entity’s Inclusion Ratio for a Low-Taxed Constituent Entity for a Fiscal Year is the ratio of (a) the GloBE Income of the Low-Taxed Constituent Entity for the Fiscal Year, reduced by the amount of such income attributable to Ownership Interests held by other owners, to (b) the GloBE Income of the Low-Taxed Constituent Entity for the Fiscal Year.

2.2.3. The amount of GloBE Income attributable to Ownership Interests in a Low-Taxed Constituent Entity held by other owners is the amount that would have been treated as attributable to such owners under the principles of the Acceptable Financial Accounting Standard used in the Ultimate Parent Entity’s Consolidated Financial Statements if the Low-Taxed Constituent Entity’s net income were equal to its GloBE Income and:

(a) the Parent Entity had prepared Consolidated Financial Statements in accordance with that accounting standard (the hypothetical Consolidated Financial Statements);

(b) the Parent Entity owned a Controlling Interest in the Low-Taxed Constituent Entity such that all of the income and expenses of the Low-Taxed Constituent Entity were consolidated on a line-by-line basis with those of the Parent Entity in the hypothetical Consolidated Financial Statements;

(c) all of the Low-Taxed Constituent Entity’s GloBE Income were attributable to transactions with persons that are not Group Entities; and

(d) all Ownership Interests not directly or indirectly held by the Parent Entity were held by persons other than Group Entities.

2.2.4. In the case of a Flow-through Entity, GloBE Income under this Article shall not include any income allocated, pursuant to Article 3.5.3, to an owner that is not a Group Entity.

Globe Rules Article 2.3. IIR Offset Mechanism

2.3.1. A Parent Entity that owns an Ownership Interest in a Low-Taxed Constituent Entity indirectly through an Intermediate Parent Entity or a Partially-Owned Parent Entity that is not eligible for an exclusion from the IIR under Article 2.1.3 or 2.1.5 shall reduce its allocable share of a Top-up Tax of the Low-Taxed Constituent Entity in accordance with Article 2.3.2.

2.3.2. The reduction in Article 2.3.1 will be an amount equal to the portion of the Parent Entity’s Allocable Share of the Top-up Tax that is brought into charge by the Intermediate Parent Entity or the Partially-Owned Parent Entity under a Qualified IIR.

Globe Rules Article 2.4. Application of the UTPR

2.4.1. Constituent Entities of an MNE Group located in [insert name of implementing-Jurisdiction] shall be denied a deduction (or required to make an equivalent adjustment under domestic law) in an amount resulting in those Constituent Entities having an additional cash tax expense equal to the UTPR Top-up Tax Amount for the Fiscal Year allocated to that jurisdiction.

2.4.2. The adjustment mentioned in Article 2.4.1 shall apply to the extent possible with respect to the taxable year in which the Fiscal Year ends. If this adjustment is insufficient to produce an additional cash tax expense for this taxable year equal to the UTPR Top-up Tax Amount allocated to [insert name of implementing-Jurisdiction] for the Fiscal Year, the difference shall be carried forward to the extent necessary to the succeeding Fiscal Years and be subject to the adjustment mentioned in Article 2.4.1 to the extent possible for each taxable year.

2.4.3. Article 2.4.1 shall not apply to a Constituent Entity that is an Investment Entity.

Globe Rules Article 2.5. UTPR Top-up Tax Amount

2.5.1. The Total UTPR Top-up Tax Amount for a Fiscal Year shall be equal to the sum of the Top-up Tax calculated for each Low-Taxed Constituent Entity of an MNE Group for that Fiscal Year (determined in accordance with Article 5.2), subject to the adjustments set out in this Article 2.5 and Article 9.3.

2.5.2. The Top-up Tax calculated for a Low-Taxed Constituent Entity that is otherwise taken into account under Article 2.5.1 shall be reduced to zero if all of the Ultimate Parent Entity’s Ownership Interests in such Low-Taxed Constituent Entity are held directly or indirectly by one or more Parent Entities that are required to apply a Qualified IIR in the jurisdiction where they are located with respect to that Low-Taxed Constituent Entity for the Fiscal Year.

2.5.3. Where Article 2.5.2 does not apply, the Top-up Tax calculated for a Low-Taxed Constituent Entity that is otherwise taken into account under Article 2.5.1 shall be reduced by a Parent Entity’s Allocable Share of the Top-up Tax of that Low-Taxed Constituent Entity that is brought into charge under a Qualified IIR.

Globe Rules Article 2.6. Allocation of Top-Up Tax for the UTPR

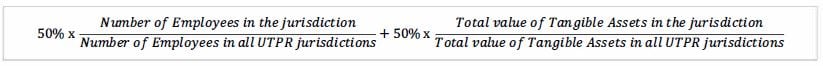

2.6.1. Subject to Articles 2.6.2 and 2.6.3, the UTPR Top-up Tax Amount allocated to [insert name of implementing-Jurisdiction] shall be determined by multiplying the Total UTPR Top-up Tax Amount determined in Article 2.5.1 by the jurisdiction’s UTPR Percentage. The UTPR Percentage of [insert name of implementing-Jurisdiction] shall be determined each Fiscal Year for each MNE Group as follows:

Where, for each Fiscal Year:

(a) the Number of Employees in the jurisdiction is the total Number of Employees of all the Constituent Entities of the MNE Group located in [insert name of implementing Jurisdiction];

(b) the Number of Employees in all UTPR Jurisdictions is the total Number of Employees of all the Constituent Entities of the MNE Group located in a jurisdiction that has a Qualified UTPR in force for the Fiscal Year;

(c) the total value of Tangible Assets in the jurisdiction is the sum of the Net Book Values of Tangible Assets of all the Constituent Entities of the MNE Group located in [insert name of implementing-Jurisdiction];

(d) the total value of Tangible Assets in all UTPR Jurisdictions is the sum of the Net Book Values of Tangible Assets of all the Constituent Entities of the MNE Group located in a jurisdiction that has a Qualified UTPR in Force for the Fiscal Year.

2.6.2. For purposes of Article 2.6.1,

(a) the Number of Employees employed and the Net Book Value of Tangible Assets held by an Investment Entity shall be excluded from the elements of the formula for allocating the Total UTPR Top-up Tax Amount;

(b) the Number of Employees employed and the Net Book Value of Tangible Assets held by a Flow-through Entity that are not allocated to Permanent Establishments shall be allocated to the Constituent Entities (if any) that are located in the jurisdiction where the Flow-through Entity was created. The Number of Employees employed and the Net Book Value of Tangible Assets held by a Flow-through Entity that are not allocated either to Permanent Establishments or under this provision shall be excluded from the formula for allocating the Total UTPR Top-up Tax Amount.

2.6.3. Notwithstanding Article 2.6.1, the UTPR Percentage of [insert name of implementing Jurisdiction] for an MNE Group is deemed to be zero for a Fiscal Year as long as the Top-Up Tax Amount allocated to [insert name of implementing-Jurisdiction] in a prior Fiscal Year has not resulted in the Constituent Entities of this MNE Group located in [insert name of implementing-Jurisdiction] having an additional cash tax expense equal, in total, to the UTPR Top-up Tax Amount for that prior Fiscal Year allocated to [insert name of implementing-Jurisdiction]. The Number of Employees and the Tangible Assets of the Constituent Entities of this MNE Group located in a jurisdiction with a UTPR Percentage of zero for a Fiscal Year shall be excluded from the formula provided under Article 2.6.1 for allocating the Total UTPR Top-up Tax Amount for that Fiscal Year.

2.6.4. Article 2.6.3 does not apply for a Fiscal Year if all jurisdictions with a Qualified UTPR in Force for the Fiscal Year have a UTPR Percentage of zero for the MNE Group for that Fiscal Year.

Globe Rules Article 3 Computation of GloBE Income or Loss

Operation of the rules in this chapter

Under this chapter, the amount of GloBE Income or Loss of a Constituent Entity is determined:

- by taking the Financial Accounting Net Income or Loss determined for the Constituent Entity for the Fiscal Year in accordance with Article 3.1; and then

- by adjusting this amount under Article 3.2 to Article 3.5 to arrive at that Entity’s GloBE Income or Loss.

Globe Rules Article 3.1. Financial Accounts

3.1.1. The GloBE Income or Loss of each Constituent Entity is the Financial Accounting Net Income or Loss determined for the Constituent Entity for the Fiscal Year adjusted for the items described in Article 3.2 to Article 3.5.

3.1.2. Financial Accounting Net Income or Loss is the net income or loss determined for a Constituent Entity (before any consolidation adjustments eliminating intra-group transactions) in preparing Consolidated Financial Statements of the Ultimate Parent Entity.

3.1.3. If it is not reasonably practicable to determine the Financial Accounting Net Income or Loss for a Constituent Entity based on the accounting standard used in the preparation of Consolidated Financial Statements of the Ultimate Parent Entity, the Financial Accounting Net Income or Loss for the Constituent Entity for the Fiscal Year may be determined using another Acceptable Financial Accounting Standard or an Authorised Financial Accounting Standard if:

(a) the financial accounts of the Constituent Entity are maintained based on that accounting standard;

(b) the information contained in the financial accounts is reliable; and

(c) permanent differences in excess of EUR 1 million that arise from the application of a particular principle or standard to items of income or expense or transactions that differs from the financial standard used in the preparation of the Consolidated Financial Statements of the Ultimate Parent Entity are conformed to the treatment required under the accounting standard used in the Consolidated Financial Statements of the Ultimate Parent Entity.

Globe Rules Article 3.2. Adjustments to determine GloBE Income or Loss

3.2.1. A Constituent Entity’s Financial Accounting Net Income or Loss is adjusted for the following items to arrive at that Entity’s GloBE Income or Loss:

(a) Net Taxes Expense;

(b) Excluded Dividends;

(c) Excluded Equity Gain or Loss;

(d) Included Revaluation Method Gain or Loss;

(e) Gain or loss from disposition of assets and liabilities excluded under Article 6.3;

(f) Asymmetric Foreign Currency Gains or Losses;

(g) Policy Disallowed Expenses;

(h) Prior Period Errors and Changes in Accounting Principles; and

(i) Accrued Pension Expense.

3.2.2. At the election of the Filing Constituent Entity, a Constituent Entity may substitute the amount allowed as a deduction in the computation of its taxable income in its location for the amount expensed in its financial accounts for a cost or expense of such Constituent Entity that was paid with stock-based compensation. If the stock-based compensation expense arises in connection with an option that expires without exercise, the Constituent Entity must include the total amount previously deducted in the computation of its GloBE Income or Loss for the Fiscal Year in which the option expires. The election is a Five-Year Election and must be applied consistently to the stock-based compensation of all Constituent Entities located in the same jurisdiction for the year in which the election is made and all subsequent Fiscal Years. If the election is made in a Fiscal Year after some of the stock-based compensation of a transaction has been recorded in the financial accounts, the Constituent Entity must include in the computation of its GloBE Income or Loss for that Fiscal Year an amount equal to the excess of the cumulative amount allowed as an expense in the computation of its GloBE Income or Loss in previous Fiscal Years over the cumulative amount that would have been allowed as an expense if the election had been in place in those Fiscal Years. If the election is revoked, the Constituent Entity must include in the computation of its GloBE Income or Loss for the revocation year the amount deducted pursuant to the election that exceeds financial accounting expense accrued in respect of the stock-based compensation that has not been paid.

3.2.3. Any transaction between Constituent Entities located in different jurisdictions that is not recorded in the same amount in the financial accounts of both Constituent Entities or that is not consistent with the Arm’s Length Principle must be adjusted so as to be in the same amount and consistent with the Arm’s Length Principle. A loss from a sale or other transfer of an asset between two Constituent Entities located in the same jurisdiction that is not recorded consistent with the Arm’s Length Principle shall be recomputed based on the Arm’s Length Principle if that loss is included in the computation of GloBE Income or Loss. Rules for allocating income or loss between a Main Entity and its Permanent Establishments are found in Article 3.4.

3.2.4. Qualified Refundable Tax Credits shall be treated as income in the computation of GloBE Income or Loss of a Constituent Entity. Non-Qualified Refundable Tax Credits shall not be treated as income in the computation of GloBE Income or Loss of a Constituent Entity.

3.2.5. With respect to assets and liabilities that are subject to fair value or impairment accounting in the Consolidated Financial Statements, a Filing Constituent Entity may elect to determine gains and losses using the realisation principle for purposes of computing GloBE Income. The election is a Five-Year Election and applies to all Constituent Entities located in the jurisdiction to which the election applies. The election applies to all assets and liabilities of such Constituent Entities, unless the Filing Constituent Entity chooses to limit the election to tangible assets of such Constituent Entities or to Constituent Entities that are Investment Entities. Under this election:

(a) all gains or losses attributable to fair value or impairment accounting with respect to an asset or liability shall be excluded from the computation of GloBE Income or Loss;

(b) the carrying value of an asset or liability for purposes of determining gain or loss shall be its carrying value at the later of:

(i) the first day of the election year, or

(ii) the date the asset was acquired or liability was incurred; and

(c) if the election is revoked, the GloBE Income or Loss of the Constituent Entities is adjusted by the difference at the beginning of the revocation year between the fair value of the asset or liability and the carrying value of the asset or liability determined pursuant to the election.

3.2.6. Where there is Aggregate Asset Gain in a jurisdiction in a Fiscal Year, the Filing Constituent Entity may make, under this Article 3.2.6, an Annual Election for that jurisdiction to adjust GloBE Income or Loss with respect to each previous Fiscal Year in the Look-back Period in the manner described in paragraphs {b) and {c) and to spread any remaining Adjusted Asset Gain over the Look-back Period in the manner described in paragraph {d).The Effective Tax Rate {ETR) and Top-up Tax, if any, for any previous Fiscal Year must be re-calculated under Article 5.4.1.When an election is made under this Article:

(a) Covered Taxes with respect to any Net Asset Gain or Net Asset Loss in the Election Year shall be excluded from the computation of Adjusted Covered Taxes.

(b) The Aggregate Asset Gain in the Election Year shall be carried-back to the earliest Loss Year and set-off ratably against any Net Asset Loss of any Constituent Entity located in that jurisdiction.

(c) If, for any Loss Year, the Adjusted Asset Gain exceeds the total amount of Net Asset Loss of all Constituent Entities located in that jurisdiction, the Adjusted Asset Gain shall be carried forward to the following Loss Year {if any) and applied ratably against any Net Asset Loss of any Constituent Entity located in that jurisdiction.

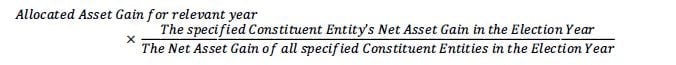

(d) Any Adjusted Asset Gain that remains after the application of paragraphs {b) and {c) shall be allocated evenly to each Fiscal Year in the Look-back Period.The Allocated Asset Gain for the relevant year shall be included in the computation of GloBE Income or Loss for a Constituent Entity located in that jurisdiction in that year in accordance with the following formula:

For the purposes of the above formula, a specified Constituent Entity is Constituent Entity that has Net Asset Gain in the Election Year and was located in the jurisdiction in the relevant year. If there is no specified Constituent Entity for a relevant year the Adjusted Asset Gain allocated to that year will be allocated equally to each Constituent Entity in the jurisdiction in that year.

3.2.7. The computation of a Low-Tax Entity’s GloBE Income or Loss shall exclude any expense attributable to an lntragroup Financing Arrangement that can reasonably be anticipated, over the expected duration of the arrangement to:

(a) increase the amount of expenses taken into account in calculating the GloBE Income or Loss of the Low-Tax Entity;

(b) without resulting in a commensurate increase in the taxable income of the High-Tax Counterparty.

3.2.8. An Ultimate Parent Entity may elect to apply its consolidated accounting treatment to eliminate income, expense, gains, and losses from transactions between Constituent Entities that are located, and included in a tax consolidation group, in the same jurisdiction for purposes of computing each such Constituent Entity’s Net GloBE Income or Loss. The election under this Article is a Five-Year Election. Upon making or revoking such election, appropriate adjustments shall be made for GloBE purposes such that there shall not be duplications or omissions of items of GloBE Income or Loss as a result of having made or revoked the election.

3.2.9. An insurance company shall exclude from the computation of GloBE Income or Loss amounts charged to policyholders for Taxes paid by the insurance company in respect of returns to the policy holders. An insurance company shall include in the computation of GloBE Income or Loss any returns to policyholders that are not reflected in Financial Accounting Net Income or Loss to the extent the corresponding increase or decrease in liability to the policyholders is reflected in its Financial Accounting Net Income or Loss.

3.2.10. Amounts recognised as a decrease to the equity of a Constituent Entity attributable to distributions paid or payable in respect of Additional Tier One Capital issued by the Constituent Entity shall be treated as an expense in the computation of its GloBE Income or Loss. Amounts recognised as an increase to the equity of a Constituent Entity attributable to distributions received or receivable in respect of Additional Tier One Capital held by the Constituent Entity shall be included in the computation of its GloBE Income or Loss.

3.2.11. A Constituent Entity’s Financial Accounting Net Income or Loss must be adjusted as necessary to reflect the requirements of the relevant provisions of Chapters 6 and 7.

Globe Rules Article 3.3. International Shipping Income exclusion

3.3.1. For an MNE Group that has International Shipping Income, each Constituent Entity’s International Shipping Income and Qualified Ancillary International Shipping Income shall be excluded from the computation of its GloBE Income or Loss under Article 3.2 for the jurisdiction in which it is located. Where the computation of a Constituent Entity’s International Shipping Income and Qualified Ancillary International Shipping Income results in a loss, the loss shall be excluded from the computation of its GloBE Income or Loss.

3.3.2. International Shipping Income means the net income obtained by a Constituent Entity from:

(a) the transportation of passengers or cargo by ships that it operates in international traffic, whether the ship is owned, leased or otherwise at the disposal of the Constituent Entity;

(b) the transportation of passengers or cargo by ships operated in international traffic under slot-chartering arrangements;

(c) leasing a ship, to be used for the transportation of passengers or cargo in international traffic, on charter fully equipped, crewed and supplied;

(d) leasing a ship on a bare boat charter basis, for the use of transportation of passengers or cargo in international traffic, to another Constituent Entity;

(e) the participation in a pool, a joint business or an international operating agency for the transportation of passengers or cargo by ships in international traffic; and

(f) the sale of a ship used for the transportation of passengers or cargo in international traffic provided that the ship has been held for use by the Constituent Entity for a minimum of one year.

International Shipping Income shall not include net income obtained from the transportation of passengers or cargo by ships via inland waterways within the same jurisdiction.

3.3.3. Qualified Ancillary International Shipping Income means net income obtained by a Constituent Entity from the following activities that are performed primarily in connection with the transportation of passengers or cargo by ships in international traffic:

(a) leasing a ship on a bare boat charter basis to another shipping enterprise that is not a Constituent Entity, provided that the charter does not exceed three years;

(b) sale of tickets issued by other shipping enterprises for the domestic leg of an international voyage;

(c) leasing and short-term storage of containers or detention charges for the late return of containers;

(d) provision of services to other shipping enterprises by engineers, maintenance staff, cargo handlers, catering staff, and customer services personnel; and

(e) investment income where the investment that generates the income is made as an integral part of the carrying on the business of operating the ships in international traffic.

3.3.4. The aggregated Qualified Ancillary International Shipping Income of all Constituent Entities located in a jurisdiction shall not exceed 50% of those Constituent Entities’ International Shipping Income.

3.3.5. The costs incurred by a Constituent Entity that are directly attributable to its international shipping activities listed in Article 3.3.2 and the costs directly attributable to its qualified ancillary activities listed in Article 3.3.3 shall be deducted from the Constituent Entity’s revenues from such activities to compute its International Shipping Income and Qualified Ancillary International Shipping Income. Other costs incurred by a Constituent Entity that are indirectly attributable to a Constituent Entity’s international shipping activities and qualified ancillary activities shall be allocated on the basis of the Constituent Entity’s revenues from such activities in proportion to its total revenues. All direct and indirect costs attributed to a Constituent Entity’s International Shipping Income and Qualified Ancillary International Shipping Income shall be excluded from the computation of its GloBE Income or Loss.

3.3.6. In order for a Constituent Entity’s International Shipping Income and Qualified Ancillary International Shipping Income to qualify for the exclusion from its GloBE Income or Loss under this Article, the Constituent Entity must demonstrate that the strategic or commercial management of all ships concerned is effectively carried on from within the jurisdiction where the Constituent Entity is located.

Globe Rules Article 3.4. Allocation of Income or Loss between a Main Entity and a Permanent Establishment

3.4.1. The Financial Accounting Net Income or Loss of a Constituent Entity that is a Permanent Establishment in accordance with paragraphs (a), (b) and (c) of the definition in Article 10.1 is the net income or loss reflected in the separate financial accounts of the Permanent Establishment. If the Permanent Establishment does not have separate financial accounts, then the Financial Accounting Net Income or Loss is the amount that would have been reflected in its separate financial accounts if prepared on a standalone basis and in accordance with the accounting standard used in the preparation of the Consolidated Financial Accounts of the Ultimate Parent Entity.

3.4.2. The Financial Accounting Net Income or Loss of a Permanent Establishment referred to in Article 3.4.1 shall be adjusted, if necessary:

(a) in the case of a Permanent Establishment as defined by paragraphs (a) and (b) of the definition in Article 10.1, to reflect only the amounts and items of income and expense that are attributable to the Permanent Establishment in accordance with the applicable Tax Treaty or domestic law of the jurisdiction where it is located regardless of the amount of income subject to tax and the amount of deductible expenses in that jurisdiction;

(b) in the case of a Permanent Establishment as defined by paragraph (c) of the definition in Article 10.1, to reflect only the amounts and items of income and expense that would have been attributed to it in accordance with Article 7 of the OECD Model Tax Convention.

3.4.3. In case of a Constituent Entity that is a Permanent Establishment in accordance with paragraph (d) of the definition in Article 10.1, its income used for computing Financial Accounting Net Income or Loss is the income being exempted in the jurisdiction where the Main Entity is located and attributable to the operations conducted outside that jurisdiction. The expenses used for computing Financial Accounting Net Income or Loss are those that are not deducted for taxable purposes in the jurisdiction where the Main Entity is located and that are attributable to such operations.

3.4.4. The Financial Accounting Net Income or Loss of a Permanent Establishment is not taken into account in determining the GloBE Income or Loss of the Main Entity, except as provided in Article 3.4.5.

3.4.5. A GloBE Loss of a Permanent Establishment shall be treated as an expense of the Main Entity (and not of the Permanent Establishment) for purposes of computing its GloBE Income or Loss to the extent that the loss of the Permanent Establishment is treated as an expense in the computation of the domestic taxable income of such Main Entity and is not set off against an item of income that is subject to tax under the laws of both the jurisdiction of the Main Entity and the jurisdiction of the Permanent Establishment. GloBE Income subsequently arising in the Permanent Establishment shall be treated as GloBE Income of the Main Entity (and not the Permanent Establishment) up to the amount of the GloBE Loss that previously was treated as an expense for purposes of computing the GloBE Income or Loss of the Main Entity.

Globe Rules Article 3.5. Allocation of Income or Loss from a Flow-through Entity

3.5.1. The Financial Accounting Net Income or Loss of a Constituent Entity that is a Flow-through Entity is allocated as follows:

(a) in the case of a Permanent Establishment through which the business of the Entity is wholly or partly carried out, the Financial Accounting Net Income or Loss of the Entity is allocated to that Permanent Establishment in accordance with Article 3.4;

(b) in the case of a Tax Transparent Entity that is not the Ultimate Parent Entity, any Financial Accounting Net Income or Loss remaining after application of paragraph (a) is allocated to its Constituent Entity-owners in accordance with their Ownership Interests; and

(c) in the case of a Tax Transparent Entity that is the Ultimate Parent Entity or a Reverse Hybrid Entity, any Financial Accounting Net Income or Loss remaining after application of paragraph (a) is allocated to it.

3.5.2. The rules of Article 3.5.1 shall be applied separately with respect to each Ownership Interest in the Flow-through Entity.

3.5.3. Prior to the application of Article 3.5.1, the Financial Accounting Net Income or Loss of a Flow-through Entity shall be reduced by the amount allocable to its owners that are not Group Entities and that hold their Ownership Interest in the Flow-through Entity directly or through a Tax Transparent Structure.

3.5.4. Article 3.5.3 does not apply to:

(a) an Ultimate Parent Entity that is a Flow-through Entity; or

(b) any Flow-through Entity owned by such an Ultimate Parent Entity (directly or through a Tax Transparent Structure).

The treatment of these Entities is addressed in Article 7.1.

3.5.5. The Financial Accounting Net Income or Loss of a Flow-through Entity is reduced by the amount that is allocated to another Constituent Entity.

Globe Rules Article 4 Computation of Adjusted Covered Taxes

Operation of the rules in this chapter

Under this chapter the amount of a Constituent Entity’s Covered Taxes, as defined in Article 4.2 is determined

- by taking the current taxes determined for the Constituent Entity for the Fiscal Year in accordance with Article 4.1, adjusted to reflect certain timing differences under Article 4.4 and Article 4.5; by allocating Covered Taxes from one Constituent Entity to another in certain cases under Article 4.3; and

- by taking into account the effect of certain post-filing tax adjustments under Article 4.6.

Globe Rules Article 4.1. Adjusted Covered Taxes

4.1.1. The Adjusted Covered Taxes of a Constituent Entity for the Fiscal Year shall be equal to the current tax expense accrued in its Financial Accounting Net Income or Loss with respect to Covered Taxes for the Fiscal Year adjusted by:

(a) the net amount of its Additions to Covered Taxes for the Fiscal Year (as determined under Article 4.1.2) and Reductions to Covered Taxes for the Fiscal Year (as determined under Article 4.1.3);

(b) the Total Deferred Tax Adjustment Amount (as determined under Article 4.4); and

(c) any increase or decrease in Covered Taxes recorded in equity or Other Comprehensive Income relating to amounts included in the computation of GloBE Income or Loss that will be subject to tax under local tax rules.

4.1.2. The Additions to Covered Taxes of a Constituent Entity for the Fiscal Year is the sum of:

(a) any amount of Covered Taxes accrued as an expense in the profit before taxation in the financial accounts;

(b) any amount of GloBE Loss Deferred Tax Asset used under Article 4.5.3;

(c) any amount of Covered Taxes that is paid in the Fiscal Year and that relates to an uncertain tax position where that amount has been treated for a previous Fiscal Year as a Reduction to Covered Taxes under Article 4.1.3(d); and

(d) any amount of credit or refund in respect of a Qualified Refundable Tax Credit that is recorded as a reduction to the current tax expense.

4.1.3. The Reductions to Covered Taxes of a Constituent Entity for the Fiscal Year is the sum of:

(a) the amount of current tax expense with respect to income excluded from the computation of GloBE Income or Loss under Chapter 3;

(b) any amount of credit or refund in respect of a Non-Qualified Refundable Tax Credit that is not recorded as a reduction to the current tax expense;

(c) any amount of Covered Taxes refunded or credited, except for any Qualified Refundable Tax Credit, to a Constituent Entity that was not treated as an adjustment to current tax expense in the financial accounts;

(d) the amount of current tax expense which relates to an uncertain tax position; and

(e) any amount of current tax expense that is not expected to be paid within three years of the last day of the Fiscal Year.

4.1.4. No amount of Covered Taxes may be taken into account more than once.

4.1.5. In a Fiscal Year in which there is no Net GloBE Income for a jurisdiction, if the Adjusted Covered Taxes for a jurisdiction are less than zero and less than the Expected Adjusted Covered Taxes Amount the Constituent Entities in that jurisdiction shall be treated as having Additional Current Top-up Tax for the jurisdiction under Article 5.4 arising in the current Fiscal Year equal to the difference between these amounts. The Expected Adjusted Covered Taxes Amount is equal to the GloBE Income or Loss for a jurisdiction multiplied by the Minimum Rate.

Globe Rules Article 4.2. Definition of Covered Taxes

4.2.1. Covered Taxes means:

(a) Taxes recorded in the financial accounts of a Constituent Entity with respect to its income or profits or its share of the income or profits of a Constituent Entity in which it owns an Ownership Interest;

(b) Taxes on distributed profits, deemed profit distributions, and non-business expenses imposed under an Eligible Distribution Tax System;

(c) Taxes imposed in lieu of a generally applicable corporate income tax; and

(d) Taxes levied by reference to retained earnings and corporate equity, including a Tax on multiple components based on income and equity.

4.2.2. Covered Taxes does not include any amount of:

(a)Top-up Tax accrued by a Parent Entity under a Qualified IIR;

(b) Top-up Tax accrued by a Constituent Entity under a Qualified Domestic Minimum Top-Up Tax;

(c) Taxes attributable to an adjustment made by a Constituent Entity as a result of the application of a Qualified UTPR;

(d) A Disqualified Refundable Imputation Tax;

(e) Taxes paid by an insurance company in respect of returns to policyholders.

Globe Rules Article 4.3. Allocation of Covered Taxes from one Constituent Entity to another Constituent Entity

4.3.1. Article 4.3.2 applies to the allocation of Covered Taxes in respect of Permanent Establishments, Tax Transparent Entities and Hybrid Entities as well as the allocation of CFC taxes and taxes on distributions from one Constituent Entity to another.

4.3.2. Covered Taxes are allocated from one Constituent Entity to another Constituent Entity as follows:

(a) the amount of any Covered Taxes included in the financial accounts of a Constituent Entity with respect to GloBE Income or Loss of a Permanent Establishment is allocated to the Permanent Establishment;

(b) the amount of any Covered Taxes included in the financial accounts of a Tax Transparent Entity with respect to GloBE Income or Loss allocated to a Constituent Entity-owner pursuant to Article 3.5.1 (b) is allocated to that Constituent Entity-owner;

(c) in the case of a Constituent Entity whose Constituent Entity-owners are subject to a Controlled Foreign Company Tax Regime, the amount of any Covered Taxes included in the financial accounts of its direct or indirect Constituent Entity-owners under a Controlled Foreign Company Tax Regime on their share of the Controlled Foreign Company’s income are allocated to the Constituent Entity;

(d) in the case of a Constituent Entity that is a Hybrid Entity the amount of any Covered Taxes included in the financial accounts of a Constituent Entity-owner on income of the Hybrid Entity is allocated to the Hybrid Entity; and

(e) the amount of any Covered Taxes accrued in the financial accounts of a Constituent Entity’s direct Constituent Entity-owners on distributions from the Constituent Entity during the Fiscal Year are allocated to the distributing Constituent Entity.

4.3.3. Covered Taxes allocated to a Constituent Entity pursuant to Article 4.3.2(c) and (d) in respect of Passive Income are included in such Constituent Entity’s Adjusted Covered Taxes in an amount equal to the lesser of:

(a) the Covered Taxes allocated in respect of such Passive Income; or

(b) the Top-up Tax Percentage for the Constituent Entity’s jurisdiction, determined without regard to the Covered Taxes incurred with respect to such Passive Income by the Constituent Entity-owner, multiplied by the amount of the Constituent Entity’s Passive Income includible under any Controlled Foreign Company Tax Regime or fiscal transparency rule.

Any Covered Taxes of the Constituent Entity-owner incurred with respect to such Passive Income that remain after the application of this Article shall not be allocated under Article 4.3.2(c) or (d).

4.3.4. Where the GloBE Income of a Permanent Establishment is treated as GloBE Income of the Main Entity pursuant to Article 3.4.5, any Covered Taxes arising in the location of the Permanent Establishment and associated with such income are treated as Covered Taxes of the Main Entity up to an amount not exceeding such income multiplied by the highest corporate tax rate on ordinary income in the jurisdiction where the Main Entity is located.

Globe Rules Article 4.4. Mechanism to address temporary differences

4.4.1. The Total Deferred Tax Adjustment Amount for a Constituent Entity for the Fiscal Year is equal to the deferred tax expense accrued in its financial accounts if the applicable tax rate is below the Minimum Rate or, in any other case, such deferred tax expense recast at the Minimum Rate, with respect to Covered Taxes for the Fiscal Year subject to the adjustments set forth in Articles 4.4.2 and 4.4.3 and the following exclusions:

(a) The amount of deferred tax expense with respect to items excluded from the computation of GloBE Income or Loss under Chapter 3;

(b) The amount of deferred tax expense with respect to Disallowed Accruals and Unclaimed Accruals;

(c)The impact of a valuation adjustment or accounting recognition adjustment with respect to a deferred tax asset;

(d) The amount of deferred tax expense arising from a re-measurement with respect to a change in the applicable domestic tax rate; and

(e) The amount of deferred tax expense with respect to the generation and use of tax credits.

4.4.2. The Total Deferred Tax Adjustment Amount is adjusted as follows:

(a) Increased by the amount of any Disallowed Accrual or Unclaimed Accrual paid during the Fiscal Year;

(b) Increased by the amount of any Recaptured Deferred Tax Liability determined in a preceding Fiscal Year which has been paid during the Fiscal Year; and

(c) Reduced by the amount that would be a reduction to the Total Deferred Tax Adjustment Amount due to recognition of a loss deferred tax asset for a current year tax loss, where a loss deferred tax asset has not been recognised because the recognition criteria are not met.

4.4.3. A deferred tax asset that has been recorded at a rate lower than the Minimum Rate may be recast at the Minimum Rate in the Fiscal Year such deferred tax asset is recorded, if the taxpayer can demonstrate that the deferred tax asset is attributable to a GloBE Loss. The Total Deferred Tax Adjustment Amount is reduced by the amount that a deferred tax asset is increased due to being recast under this Article.

4.4.4. To the extent a deferred tax liability, that is not a Recapture Exception Accrual, is taken into account under this Article and such amount is not paid within the five subsequent Fiscal Years, the amount must be recaptured pursuant to this article. The Amount of the Recaptured Deferred Tax Liability determined for the current Fiscal Year shall be treated as a reduction to Covered Taxes in the fifth preceding Fiscal Year and the Effective Tax Rate and Top-up Tax of such Fiscal Year shall be recalculated under the rules of Article 5.4.1. The Recaptured Deferred Tax Liability for the current Fiscal Year is the amount of the increase in a category of deferred tax liability that was included in the Total Deferred Tax Adjustment Amount in the fifth preceding Fiscal Year that has not reversed by the end of the last day of the current Fiscal Year, unless such amount relates to a Recapture Exception Accrual as set forth in Article 4.4.5.

4.4.5. Recapture Exception Accrual means the tax expense accrued attributable to changes in associated deferred tax liabilities, in respect of:

(a) Cost recovery allowances on tangible assets

(b) The cost of a licence or similar arrangement from the government for the use of immovable property or exploitation of natural resources that entails significant investment in tangible assets;

(c) Research and development expenses;

(d) De-commissioning and remediation expenses;

(e) Fair value accounting on unrealised net gains;

(f) Foreign currency exchange net gains;

(g) Insurance reserves and insurance policy deferred acquisition costs;

(h) Gains from the sale of tangible property located in the same jurisdiction as the Constituent Entity that are reinvested in tangible property in the same jurisdiction; and

(i) Additional amounts accrued as a result of accounting principle changes with respect to categories (a) through (h).

4.4.6. Disallowed Accrual means:

(a) Any movement in deferred tax expense accrued in the financial accounts of a Constituent Entity which relates to an uncertain tax position; and

(b) Any movement in deferred tax expense accrued in the financial accounts of a Constituent Entity which relates to distributions from a Constituent Entity.

4.4.7. Unclaimed Accrual means any increase in a deferred tax liability recorded in the financial accounts of a Constituent Entity for a Fiscal Year that is not expected to be paid within the time period set forth in Article 4.4.4 and for which the Filing Constituent Entity makes an Annual Election not to include in Total Deferred Tax Adjustment Amount for such Fiscal Year.

Globe Rules Article 4.5. The GloBE Loss Election

4.5.1. In lieu of applying the rules set forth in Article 4.4, a Filing Constituent Entity may make a GloBE Loss Election for a jurisdiction. When a GloBE Loss Election is made for a jurisdiction, a GloBE Loss Deferred Tax Asset is established in each Fiscal Year in which there is a Net GloBE Loss for the jurisdiction. The GloBE Loss Deferred Tax Asset is equal to the Net GloBE Loss in a Fiscal Year for the jurisdiction multiplied by the Minimum Rate.

4.5.2. The balance of the GloBE Loss Deferred Tax Asset is carried forward to subsequent Fiscal Years, reduced by the amount of GloBE Loss Deferred Tax Asset used in a Fiscal Year.

4.5.3. The GloBE Loss Deferred Tax Asset must be used in any subsequent Fiscal Year in which there is Net GloBE Income for the jurisdiction in an amount equal to the lower of the Net GloBE Income multiplied by the Minimum Rate or the amount of available GloBE Loss Deferred Tax Asset.

4.5.4. If the GloBE Loss Election is subsequently revoked, any remaining GloBE Loss Deferred Tax Asset is reduced to zero, effective as of the first day of the first Fiscal Year in which the GloBE Loss Election is no longer applicable.

4.5.5. The GloBE Loss Election must be filed with the first GloBE Information Return of the MNE Group that includes the jurisdiction for which the election is made. A GloBE Loss Election cannot be made for a jurisdiction with an Eligible Distribution Tax System as defined in Article 7.3.

4.5.6. A Flow-through Entity that is a UPE of an MNE Group may make a GloBE Loss Election under this Article. When such an election is made, the GloBE Loss Deferred Tax Asset shall be calculated in accordance with Articles 4.5.1 to 4.5.5, however, the GloBE Loss Deferred Tax Asset shall be calculated with reference to the GloBE Loss of the Flow-through Entity after reduction in accordance with Article 7.1.2.

Globe Rules Article 4.6. Post-filing Adjustments and Tax Rate Changes

4.6.1. An adjustment to a Constituent Entity’s liability for Covered Taxes for a previous Fiscal Year recorded in the financial accounts shall be treated as an adjustment to Covered Taxes in the Fiscal Year in which the adjustment is made, unless the adjustment relates to a Fiscal Year in which there is a decrease in Covered Taxes for the jurisdiction. In the case of a decrease in Covered Taxes included in the Constituent Entity’s Adjusted Covered Taxes for a previous Fiscal Year, the Effective Tax Rate and Top-up Tax for such Fiscal Year must be recalculated under Article 5.4.1. In the Article 5.4.1 recalculations, the Adjusted Covered Taxes determined for the Fiscal Year shall be reduced by the amount of the decrease in Covered Taxes and GloBE Income determined for the Fiscal Year and any intervening Fiscal Years shall be adjusted as necessary and appropriate. A Filing Constituent Entity may make an Annual Election to treat an immaterial decrease in Covered Taxes as an adjustment to Covered Taxes in the Fiscal Year in which the adjustment is made. An immaterial decrease in Covered Taxes is an aggregate decrease of less than EUR 1 million in the Adjusted Covered Taxes determined for the jurisdiction for a Fiscal Year.

4.6.2. The amount of deferred tax expense resulting from a reduction to the applicable domestic tax rate shall be treated as an adjustment to a Constituent Entity’s liability for Covered Taxes claimed under Article 4.1 for a previous Fiscal Year when such reduction results in the application of a rate that is less than the Minimum Rate.

4.6.3. The amount of deferred tax expense, when paid, that has resulted from an increase to the applicable domestic tax rate shall be treated as an adjustment under Article 4.6.1 to a Constituent Entity’s liability for Covered Taxes claimed under Article 4.1 for a previous Fiscal Year when such amount was originally recorded at a rate less than the Minimum Rate. This adjustment is limited to an amount that is equal to an increase of deferred tax expense up to such deferred tax expense recast at the Minimum Rate.

4.6.4. If more than EUR 1 million of the amount accrued by a Constituent Entity as current tax expense and included in Adjusted Covered Taxes for a Fiscal Year is not paid within three years of the last day of such year, the Effective Tax Rate and Top-up Tax for the Fiscal Year in which the unpaid amount was claimed as a Covered Tax must be recalculated in accordance with Article 5.4.1 by excluding such unpaid amount from Adjusted Covered Taxes.

Globe Rules Article 5 Computation of Effective Tax Rate and Top-up Tax

Operation of the rules in this chapter

Under this chapter the Top-up Tax of each Low-Taxed Constituent Entity is determined:

- by aggregating each Constituent Entity’s GloBE Income or Loss, determined under Chapter 3, and Adjusted Covered Taxes, determined under Chapter 4, with those of other Constituent Entities located in the same jurisdiction to determine an Effective Tax Rate for the jurisdiction;

- by identifying which jurisdiction is a Low-Tax Jurisdiction (i.e. has an Effective Tax Rate that is below the Minimum Rate);

- by computing a jurisdictional Top-Up Tax Percentage for each Low-Tax Jurisdiction;

- by applying the Substance-based Income Exclusion to the Net GloBE Income in the Low-Tax Jurisdiction to determine the Excess Profits in that jurisdiction;

- by multiplying the Top-up Tax percentage by such Excess Profit and reducing the result by the amount of any Qualified Domestic Minimum Top-up Tax to determine the Top-Up Tax for each Low-Tax Jurisdiction; and

- by allocating such Top-up Taxes to the Constituent Entities in the Low-Tax Jurisdiction in proportion to their GloBE Income.

The resulting Top-up Tax of each Low Tax Constituent Entity is then charged to a Parent Entity or to Constituent Entities located in a UTPR Jurisdiction under Chapter 2.

This chapter also includes a de minimis exclusion for the Constituent Entities located in the same jurisdiction when their aggregated revenue and income does not exceed certain thresholds. Special rules are provided in Article 5.6 for calculating the ETR in respect of Minority-Owned Constituent Entities.

Globe Rules Article 5.1. Determination of Effective Tax Rate

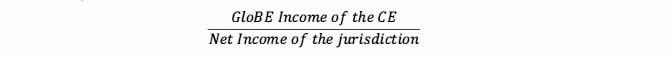

5.1.1. The Effective Tax Rate of the MNE Group for a jurisdiction with Net GloBE Income shall be calculated for each Fiscal Year. The Effective Tax Rate of the MNE Group for a jurisdiction is equal to the sum of the Adjusted Covered Taxes of each Constituent Entity located in the jurisdiction divided by the Net GloBE Income of the jurisdiction for the Fiscal Year. For purposes of Chapter 5, each Stateless Constituent Entity shall be treated as a single Constituent Entity located in a separate jurisdiction.

5.1.2. The Net GloBE Income of a jurisdiction for a Fiscal Year is the positive amount, if any, computed in accordance with the following formula:

![]()

Where:

(a) the GloBE Income of all Constituent Entities is the sum of the GloBE Income of all Constituent Entities located in the jurisdiction determined in accordance with Chapter 3 for the Fiscal Year; and

(b) the GloBE Losses of all Constituent Entities is the sum of the GloBE Losses of all Constituent Entities located in the jurisdiction determined in accordance with Chapter 3 for the Fiscal Year.

5.1.3. Adjusted Covered Taxes and GloBE Income or Loss of Constituent Entities that are Investment Entities are excluded from the determination of the Effective Tax Rate in Article 5.1.1 and the determination of Net GloBE Income in Article 5.1.2.

Globe Rules Article 5.2. Top-up Tax

5.2.1. The Top-up Tax Percentage for a jurisdiction for a Fiscal Year shall be the positive percentage point difference, if any, computed in accordance with the following formula:

Top up Tax Percentage = Minimum Rate – Effective Tax Rate

Where the Effective Tax Rate is the Effective Tax Rate determined in accordance with Article 5.1 for the jurisdiction for the Fiscal Year.

5.2.2. The Excess Profit for the jurisdiction for the Fiscal Year is the positive amount, if any, computed in accordance with the following formula:

Excess Profit= Net GloBE Income – Substance based Income Exclusion

Where:

(a) The Net GloBE Income is the Net GloBE Income determined under Article 5.1.2 for the jurisdiction for the Fiscal Year; and

(b) The Substance-based Income Exclusion is the Substance-based Income Exclusion determined under Article 5.3 for the jurisdiction for the Fiscal Year (if any).

5.2.3. The Jurisdictional Top-up Tax for a jurisdiction for a Fiscal Year is equal to the positive amount, if any, computed in accordance with the following formula:

Jurisdictional Top up Tax

= (Top up Tax Percentage x Excess Profit)+ Additional Current Top up Tax – Domestic Top up Tax

Where:

(a) The Top-up Tax Percentage is percentage point difference determined in accordance with Article 5.2.1 for the jurisdiction for the Fiscal Year;

(b) The Excess Profit is the Excess Profit determined in accordance with Article 5.2.2 for the jurisdiction for the Fiscal Year;

(c) The Additional Current Top-up Tax is the amount determined, or treated as Additional Current Top-up Tax, under Article 4.1.5 or Article 5.4.1 for the jurisdiction for the Fiscal Year; and

(d) The Domestic Top-up Tax is the amount payable under a Qualified Domestic Minimum Top-Up Tax of the jurisdiction for the Fiscal Year.

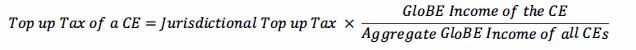

5.2.4. Except as provided in Article 5.4.3, the Top-up Tax of a Constituent Entity shall be determined for each Constituent Entity of a jurisdiction that has GloBE Income determined in accordance with Chapter 3 for the Fiscal Year included in the computation of Net GloBE Income of that jurisdiction in accordance with the following formula:

Where:

GloBE Income of the CE Aggregate GloBE Income of all CEs

(a) The Jurisdictional Top-up Tax is the Top-up Tax determined in accordance with Article 5.2.3 for the jurisdiction for the Fiscal Year;

(b) The GloBE Income of the CE is the GloBE Income of the Constituent Entity determined in accordance with Article 3.2 for the jurisdiction for the Fiscal Year;

(c) The aggregate GloBE Income of all CEs is the aggregate GloBE Income of all Constituent Entities that have GloBE Income for the Fiscal Year included in the computation of Net GloBE Income in accordance with Article 5.1.2 for the jurisdiction for the Fiscal Year.

5.2.5. If the Jurisdictional Top-up Tax is attributable to a recalculation under the Article 5.4.1 and the jurisdiction does not have Net GloBE Income for the current Fiscal Year, Top-up Tax shall be allocated using the formula in Article 5.2.4 based on the GloBE Income of the Constituent Entities in the Fiscal Years for which the recalculations under Article 5.4.1 were performed.

Globe Rules Article 5.3. Substance-based Income Exclusion

5.3.1. The Net GloBE Income for the jurisdiction shall be reduced by the Substance-based Income Exclusion for the jurisdiction to determine the Excess Profit for purposes of computing the Top-up Tax under Article 5.2. A Filing Constituent Entity of an MNE Group may make an Annual Election not to apply the Substance-based Income Exclusion for a jurisdiction by not computing the exclusion or claiming it in the computation of Top-up Tax for the jurisdiction in the GloBE Information Return(s) filed for the Fiscal Year.

5.3.2. The Substance-based Income Exclusion amount for a jurisdiction is the sum of the payroll carve-out and the tangible asset carve-out for each Constituent Entity, except for Constituent Entities that are Investment Entities, in that jurisdiction.

5.3.3. The payroll carve-out for a Constituent Entity located in a jurisdiction is equal to 5% of its Eligible Payroll Costs of Eligible Employees that perform activities for the MNE Group in such jurisdiction, except Eligible Payroll costs that are:

(a) capitalised and included in the carrying value of Eligible Tangible Assets;

(b) attributable to a Constituent Entity’s International Shipping Income and Qualified Ancillary International Shipping Income under Article 3.3.5 that is excluded from the computation of GloBE Income or Loss for the Fiscal Year.

5.3.4. The tangible asset carve-out for a Constituent Entity located in a jurisdiction is equal to 5% of the carrying value of Eligible Tangible Assets located in such jurisdiction. Eligible Tangible Assets means:

(a) property, plant, and equipment located in that jurisdiction;

(b) natural resources located in that jurisdiction;

(c) a lessee’s right of use of tangible assets located in that jurisdiction; and

(d) a licence or similar arrangement from the government for the use of immovable property or exploitation of natural resources that entails significant investment in tangible assets.

For this purpose, the tangible asset carve-out computation shall not include the carrying value of property (including land or buildings) that is held for sale, lease or investment. The tangible asset carve-out computation shall not include the carrying value of tangible assets used in the generation of a Constituent Entity’s International Shipping Income and Qualified Ancillary International Shipping Income (i.e. ships and other maritime equipment and infrastructure). The carrying value of tangible assets attributable to a Constituent Entity’s excess income over the cap for Qualified Ancillary International Shipping Income under Article 3.3.4 shall be included in the tangible asset carve-out computation.

5.3.5. The computation of carrying value of Eligible Tangible Assets for purposes of Article 5.3.4 shall be based on the average of the carrying value (net of accumulated depreciation, amortisation, or depletion and including any amount attributable to capitalisation of payroll expense) at the beginning and ending of the Reporting Fiscal Year as recorded for the purposes of preparing the Consolidated Financial Statements of the Ultimate Parent Entity.

5.3.6. For purposes of Articles 5.3.3 and 5.3.4, the Eligible Payroll Costs and Eligible Tangible Assets of a Constituent Entity that is a Permanent Establishment are those included in its separate financial accounts as determined by Article 3.4.1 and adjusted in accordance with Article 3.4.2, provided that the Eligible Employees and Eligible Tangible Assets are located in the jurisdiction where the Permanent Establishment is located. The Eligible Payroll Costs and Eligible Tangible Assets of a Permanent Establishment are not taken into account for the Eligible Payroll Costs and Eligible Tangible Assets of the Main Entity. The Eligible Payroll Costs and Eligible Tangible Assets of a Permanent Establishment whose income has been wholly or partly excluded in accordance with Articles 3.5.3 and 7.1.4 are excluded from the Substance-based Income Exclusion computations of the MNE Group in the same proportion.

5.3.7. For purposes of Articles 5.3.3 and 5.3.4, Eligible Payroll Costs and Eligible Tangible Assets of a Flow-through Entity that are not allocated under Article 5.3.6 are allocated as follows:

(a) if the Financial Accounting Net Income or Loss of the Flow-through Entity has been allocated to the Constituent Entity-owner under Article 3.5.1

(b), then the Entity’s Eligible Payroll Costs and Eligible Tangible Assets are allocated in the same proportion to the Constituent Entity-owner provided it is located in the jurisdiction where the Eligible Employees and Eligible Tangible Assets are located;

(b) if the Flow-through Entity is the Ultimate Parent Entity, then Eligible Payroll Costs and Eligible Tangible Assets located in the jurisdiction where the Ultimate Parent Entity is located are allocated to it and reduced in proportion to the income that is excluded under Article 7.1.1; and

(c) all other Eligible Payroll Costs and Eligible Tangible Assets of the Flow-through Entity are excluded from the Substance-based Income Exclusion computations of the MNE Group.

Globe Rules Article 5.4. Additional Current Top-up Tax

5.4.1. If the Effective Tax Rate and Top-up Tax for a prior Fiscal Year is required or permitted to be recalculated pursuant to an ETR Adjustment Article,

(a) the Effective Tax Rate and Top-Up Tax for the prior Fiscal Year shall be recalculated in accordance with the rules of Article 5.1 through Article 5.3 after taking into account the adjustments to Adjusted Covered Taxes and GloBE Income or Loss required by the relevant ETR Adjustment Article; and

(b) any amount of incremental Top-up Tax resulting from such recalculation shall be treated as Additional Current Top-up Tax under Article 5.2.3 arising in the current Fiscal Year.

5.4.2. If there is Additional Current Top-up Tax attributable to a recalculation under Article 5.4.1 and the jurisdiction does not have Net GloBE Income for the current Fiscal Year, the GloBE Income of each Constituent Entity located in the jurisdiction for purposes of Article 2.2.2 shall be equal to the result of the Top-up Tax allocated to such Entity under Articles 5.2.4 and 5.2.5 divided by the Minimum Rate.

5.4.3. If there is Additional Current Top-up Tax attributable to the operation of Article 4.1.5, the GloBE Income of each Constituent Entity located in the jurisdiction for purposes of Article 2.2.2 shall be equal to the result of the Top-up Tax allocated to such Entity under this Article divided by the Minimum Rate. The amount of Additional Current Top-up Tax allocated to each Constituent Entity for purposes of this Article shall be allocated only to Constituent Entities that record an Adjusted Covered Taxes amount that is less than zero and less than the GloBE Income or Loss of such Constituent Entity multiplied by the Minimum Rate. The allocation shall be made pro-rata based upon the following amount for each of those Constituent Entities:

(GloBE Income or Loss x Minimum Rate) – Adjusted Covered Taxes

5.4.4. If a Constituent Entity is allocated Additional Current top-up Tax pursuant to this Article and Article 5.2.4 such Constituent Entity shall be treated as a Low-Taxed Constituent Entity for the purposes of Chapter 2.

Globe Rules Article 5.5. De minimis exclusion

5.5.1. At the election of the Filing Constituent Entity, and notwithstanding the requirements otherwise provided in Chapter 5, the Top-up Tax for the Constituent Entities located in a jurisdiction shall be deemed to be zero for a Fiscal Year if, for such Fiscal Year:

(a) the Average GloBE Revenue of such jurisdiction is less than EUR 10 million; and

(b) the Average GloBE Income or Loss of such jurisdiction is a loss or is less than EUR 1 million.

The election under this Article is an Annual Election.

5.5.2. For purposes of Article 5.5.1, the Average GloBE Revenue (or GloBE Income or Loss) of a jurisdiction is the average of the GloBE Revenue (or GloBE Income or Loss) of the jurisdiction for the current and the two preceding Fiscal Years. If there were no Constituent Entities with GloBE Revenue or GloBE Losses that were located in the jurisdiction in the first or second preceding Fiscal Year, such year or years shall be excluded from the calculation of the Average GloBE Revenue and the Average GloBE Income or Loss of the relevant jurisdiction.

5.5.3. For purposes of Article 5.5.2:

(a) the GloBE Revenue of a jurisdiction for a Fiscal Year is the sum of the revenue of all Constituent Entities located in the jurisdiction for such Fiscal Year, taking into account the adjustments calculated in accordance with Chapter 3; and

(b) the GloBE Income or Loss of a jurisdiction for a Fiscal Year is the Net GloBE Income of that jurisdiction, if any, or the Net GloBE Loss of that jurisdiction.

5.5.4. An election under Article 5.5 shall not apply to a Constituent Entity that is a Stateless Constituent Entity or an Investment Entity and the revenue and GloBE Income or Loss of a Stateless Constituent Entity and of an Investment Entity shall be excluded from the computations in Article 5.5.3.

Globe Rules Article 5.6. Minority-Owned Constituent Entities

5.6.1. The computation of the Effective Tax Rate and Top-up Tax for a jurisdiction in accordance with Chapters 3 to 7, and Article 8.2 with respect to members of a Minority-Owned Subgroup shall apply as if they were a separate MNE Group. The Adjusted Covered Taxes and GloBE Income or Loss of members of a Minority-Owned Subgroup are excluded from the determination of the remainder of the MNE Group’s Effective Tax Rate in Article 5.1.1 and Net GloBE Income in Article 5.1.2.

5.6.2. The Effective Tax Rate and Top-up Tax of a Minority-Owned Constituent Entity that is not a member of a Minority-Owned Subgroup is computed on an entity basis in accordance with Chapters 3 to 7, and Article 8.2. The Adjusted Covered Taxes and GloBE Income or Loss of the Minority-Owned Constituent Entity are excluded from the determination of the remainder of the MNE Group’s Effective Tax Rate in Article 5.1.1 and Net GloBE Income in Article 5.1.2. This provision does not apply if the Minority-Owned Constituent Entity is an Investment Entity.

Globe Rules Article 6 Corporate Restructurings and Holding Structures

Operation of the rules in this chapter

Chapter 6 contains rules relating to acquisitions, disposals and Joint Ventures.

- Article 6.1 supplements Article 1.1 by providing further rules for applying the consolidated revenue threshold in the case of merger and demerger transactions that took place in the prior four year period.

- Article 6.2 provides special rules for the application of the GloBE Rules that apply when a Constituent Entity enters or leaves an MNE Group during the Fiscal Year.

- Article 6.3 provides special rules for the treatment of transfers of assets and liabilities including as part of a reorganisation.

- Article 6.4 brings certain Joint Ventures within the scope of the GloBE Rules.

- Article 6.5 provides special rules for Multi-Parented MNE Groups.

Globe Rules Article 6.1. Application of Consolidated Revenue Threshold to Group Mergers and Demergers

6.1.1. For the purposes of Article 1.1

(a) If two or more Groups merge to form a single Group in any of the four Fiscal Years prior to the tested Fiscal Year, then the consolidated revenue threshold of the MNE Group for any Fiscal Year prior to the merger is deemed to be met for that year if the sum of the revenue included in each of their Consolidated Financial Statements for that year is equal to or greater than EUR 750 million.

(b) Where an Entity that is not a member of any Group (target) merges with an Entity or Group (acquirer) in the tested Fiscal Year and the target or acquirer does not have Consolidated Financial Statements in any of the four Fiscal Years prior to the tested Fiscal Year because it was not a member of any Group in that year, the consolidated revenue threshold of the MNE Group is deemed to be met for that year if the sum of the revenue included in each of their Financial Statements or Consolidated Financial Statements for that year is equal to or greater than EUR 750 million.

(c) Where a single MNE Group within the scope of the GloBE Rules demerges into two or more Groups (each a demerged Group), the consolidated revenue threshold is deemed to be met by a demerged Group:

i. with respect to the first tested Fiscal Year ending after the demerger, if the demerged Group has annual revenues of EUR 750 million or more in that year;

ii. with respect to the second to fourth tested Fiscal Years ending after the demerger, if the demerged Group has annual revenues of EUR 750 million or more in at least two of the Fiscal Years following the year of the demerger.

6.1.2. For the purposes of Article 6.1.1 a merger is any arrangement where :

(a) all or substantially all of the Group Entities of two or more separate Groups are brought under common control such that they constitute Group Entities of a combined Group; or

(b) an Entity that is not a member of any Group is brought under common control with another Entity or Group such that they constitute Group Entities of a combined Group.

6.1.3. For the purposes of Article 6.1.1 a demerger is any arrangement where the Group Entities of a single Group are separated into two or more Groups that are no longer consolidated by the same Ultimate Parent Entity.

Globe Rules Article 6.2. Constituent Entities joining and leaving an MNE Group

6.2.1. Except to the extent provided in Article 6.2.2, the following provisions apply where an Entity (the target) becomes or ceases to be a Constituent Entity of an MNE Group as a result of a transfer of direct or indirect Ownership Interests in such Entity during the Fiscal Year (the acquisition year):

(a) where the target joins or leaves a Group or the target becomes the Ultimate Parent Entity of a new Group, the target will be treated as a member of the Group for the purposes of the GloBE Rules if any portion of its assets, liabilities, income, expenses or cash flows are included on a line-by-line basis in the Consolidated Financial Statements of the Ultimate Parent Entity in the acquisition year;

(b) in the acquisition year, an MNE Group shall take into account only the Financial Accounting Net Income or Loss and Adjusted Covered Taxes of the target that are taken into account in the Consolidated Financial Statements of the Ultimate Parent Entity for purposes of applying the GloBE Rules;

(c) in the acquisition year and each succeeding year, the target shall determine its GloBE Income or Loss and Adjusted Covered Taxes using its historical carrying value of the assets and liabilities;

(d) the computation of the target’s Eligible Payroll Costs under Article 5.3.3 shall take into account only those costs reflected in the Consolidated Financial Statements of the Ultimate Parent Entity;

(e) the computation of carrying value of the target’s Eligible Tangible Assets for purposes of Article 5.3.4 shall be adjusted proportionally to correspond with the length of the relevant Fiscal Year that the target was a member of the MNE Group;

(f) with the exception of the GloBE Loss Deferred Tax Asset, the deferred tax assets and deferred tax liabilities of a Constituent Entity that are transferred between MNE Groups shall be taken into account under the GloBE Rules by the acquiring MNE Group in the same manner and to the same extent as if the acquiring MNE Group controlled the Constituent Entity when such assets and liabilities arose;

(g) deferred tax liabilities of a target that have previously been included in its Total Deferred Tax Adjustment Amount shall be treated as reversed for purposes of applying Article 4.4.4 by the disposing MNE Group and treated as arising in the acquisition year for purposes of applying Article 4.4.4 by the acquiring MNE Group, except that in such cases any subsequent reduction to Covered Taxes under Article 4.4.4 shall have effect in the year in which the amount is recaptured ; and

(h) if the target is a Parent Entity and it is a Group Entity of two or more MNE Groups during the acquisition year, it shall apply separately the provisions of the IIR to its Allocable Shares of the Top-up Tax of Low-Taxed Constituent Entities determined for each MNE Group.

6.2.2. For purposes of the GloBE Rules, the acquisition or disposal of a Controlling Interest in a Constituent Entity will be treated as an acquisition or disposal of the assets and liabilities if the jurisdiction in which the target Constituent Entity is located, or in the case of a Tax Transparent Entity, the jurisdiction in which the assets are located, treats the acquisition or disposal of that Controlling Interest in the same or similar manner as an acquisition or disposition of the assets and liabilities and imposes a Covered Tax on the seller based on the difference between the tax basis and the consideration paid in exchange for the Controlling Interest or the fair value of the assets and liabilities.

Globe Rules Article 6.3. Transfer of Assets and Liabilities

6.3.1. In the case of a disposition or acquisition of assets and liabilities, a disposing Constituent Entity will include the gain or loss on disposition in the computation of its GloBE Income or Loss and an acquiring Constituent Entity will determine its GloBE Income or Loss using the acquiring Constituent Entity’s carrying value of the acquired assets and liabilities determined under the accounting standard used in preparing Consolidated Financial Statements of the Ultimate Parent Entity.

6.3.2. If the disposition or acquisition of assets and liabilities is part of a GloBE Reorganisation Article 6.3.1 shall not apply and:

(a) a disposing Constituent Entity will exclude any gain or loss on the disposition from the computation of its GloBE Income or Loss; and

(b) an acquiring Constituent Entity will determine its GloBE Income or Loss after the acquisition using the disposing Entity’s carrying values of the acquired assets and liabilities upon disposition.

6.3.3. If a disposition or acquisition of assets and liabilities is part of a GloBE Reorganisation in which a disposing Constituent Entity recognises Non-qualifying Gain or Loss, Articles 6.3.1 and 6.3.2 shall not apply and:

(a) the disposing Constituent Entity will include gain or loss on the disposition in its GloBE Income or Loss computation to the extent of the Non-qualifying Gain or Loss; and