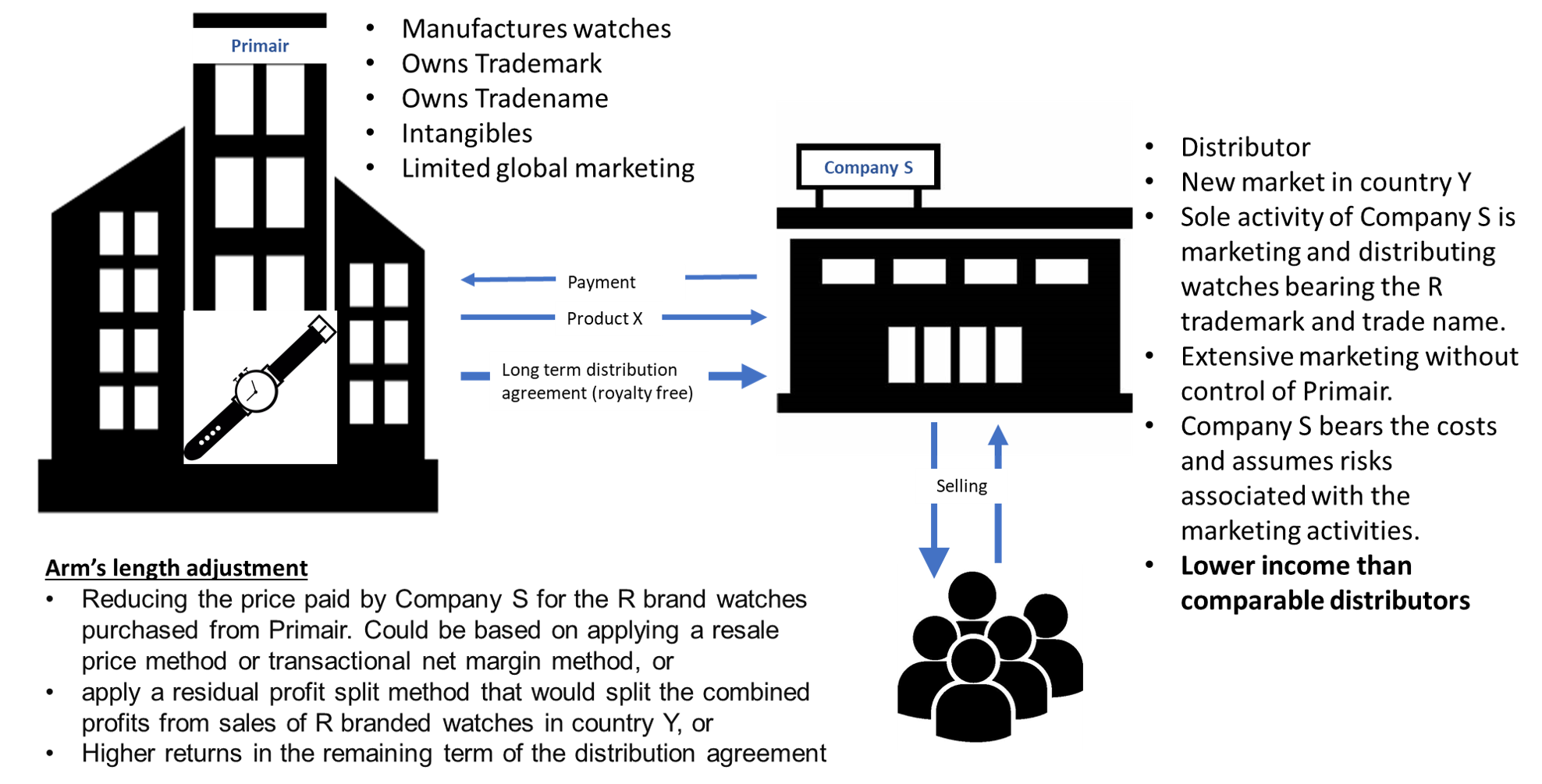

30. The facts in this example are the same as in Example 9, except that the market development functions undertaken by Company S in this Example 10 are far more extensive than those undertaken by Company S in Example 9.

31. Where the marketer/distributor actually bears the costs and assumes the risks of its marketing activities, the issue is the extent to which the marketer/distributor can share in the potential benefits from those activities. A thorough comparability analysis identifies several uncontrolled companies engaged in marketing and distribution functions under similar long-term marketing and distribution arrangements. Assume, however, that the level of marketing expense Company S incurred in Years 1 through 5 far exceeds that incurred by the identified comparable independent marketers and distributors. Assume further that the high level of expense incurred by Company S reflects its performance of additional or more intensive functions than those performed by the potential comparables and that Primair and Company S expect those additional functions to generate higher margins or increased sales volume for the products. Given the extent of the market development activities undertaken by Company S, it is evident that Company S has made a larger functional contribution to development of the market and the marketing intangibles and has assumed significantly greater costs and assumed greater risks than the identified potentially comparable independent enterprises (and substantially higher costs and risks than in Example 9). There is also evidence to support the conclusion that the profits realised by Company S are significantly lower than the profit margins of the identified potentially comparable independent marketers and distributors during the corresponding years of similar long-term marketing and distribution agreements.

32. As in Example 9, Company S bears the costs and associated risks of its marketing activities under a long-term contract of exclusive marketing and distribution rights for the R watches, and therefore expects to have an opportunity to benefit (or suffer a loss) from the marketing and distribution activities it undertakes. However, in this case Company S has performed functions and borne marketing expenditures beyond what independent enterprises in potentially comparable transactions with similar rights incur for their own benefit, resulting in significantly lower profit margins for Company S than are made by such enterprises.

33. Based on these facts, it is evident that by performing functions and incurring marketing expenditure substantially in excess of the levels of function and expenditure of independent marketer/distributors in comparable transactions, Company S has not been adequately compensated by the margins it earns on the resale of R watches. Under such circumstances it would be appropriate for the country Y tax administration to propose a transfer pricing adjustment based on compensating Company S for the marketing activities performed (taking account of the risks assumed and the expenditure incurred) on a basis that is consistent with what independent enterprises would have earned in comparable transactions. Depending on the facts and circumstances reflected in a detailed comparability analysis, such an adjustment could be based on:

- Reducing the price paid by Company S for the R brand watches purchased from Primair. Such an adjustment could be based on applying a resale price method or transactional net margin method using available data about profits made by comparable marketers and distributors with a comparable level of marketing and distribution expenditure if such comparables can be identified.

- An alternative approach might apply a residual profit split method that would split the combined profits from sales of R branded watches in country Y by first giving Company S and Primair a basic return for the functions they perform and then splitting the residual profit on a basis that takes into account the relative contributions of both Company S and Primair to the generation of income and the value of the R trademark and trade name.

- Directly compensating Company S for the excess marketing expenditure it has incurred over and above that incurred by comparable independent enterprises including an appropriate profit element for the functions and risks reflected by those expenditures.

34. In this example, the proposed adjustment is based on Company S’s having performed functions, assumed risks, and incurred costs that contributed to the development of the marketing intangibles for which it was not adequately compensated under its arrangement with Primair. If the arrangements between Company S and Primair were such that Company S could expect to obtain an arm’s length return on its additional investment during the remaining term of the distribution agreement, a different outcome could be appropriate.